Car Loan Interest Rate

Introduction:

In today’s fast-paced world, owning a car has become a necessity rather than a luxury for many individuals. However, buying a car often involves a significant financial investment, which may require assistance in the form of a car loan. Understanding the intricacies of car loans, including interest rates, loan calculators and different lenders like SBI and HDFC, is essential to making informed decisions and securing the best deal possible.

Deciphering Car Loan Interest Rates

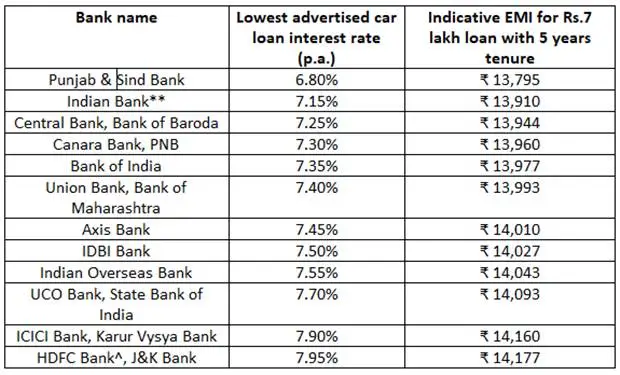

Car loan interest rates play a key role in determining the total cost of borrowing and can significantly affect monthly payments. Lenders typically offer interest rates based on a variety of factors, including credit history, loan term and prevailing market conditions. It is essential for potential borrowers to compare interest rates from different lenders to determine the most competitive options. Additionally, being informed about interest rate fluctuations can help borrowers take advantage of favorable opportunities and secure lower rates.

Harnessing the Power of Car Loan Calculators

Car loan calculators are invaluable tools that allow borrowers to accurately estimate their monthly payments. These calculators take into account factors such as loan amount, interest rate and loan term to give borrowers a clear picture of their financial obligations. By adjusting these variables, individuals can explore different scenarios and identify repayment plans that are consistent with their budget constraints. Additionally, using car loan calculators allows borrowers to compare offers from multiple lenders and make informed decisions tailored to their specific needs.Car Loan Interest Rate

Survey of SBI Car Loans: Interest Rates and Benefits

State Bank of India (SBI) is one of the leading lenders offering competitive car loan options to customers. With attractive interest rates and flexible repayment terms, SBI car loans cater to various financial requirements. Prospective borrowers can use SBI’s online tools, including a car loan EMI calculator, to assess affordability and effectively plan a repayment strategy. Additionally, SBI’s transparent loan processing and minimal documentation requirements simplify the lending process and ensure a hassle-free experience for customers.Car Loan Interest Rate

Unlocking Opportunities with HDFC Car Loans

Housing Development Finance Corporation Limited (HDFC) is another major player in the car loan market, known for its customer-centric approach and innovative financing solutions. HDFC offers competitive interest rates on car loans along with personalized assistance that guides borrowers through every step of the application process. Using the HDFC Car Loan Calculator, individuals can get an overview of repayment schedules and choose the loan options that best suit their financial goals. Moreover, HDFC’s extensive network and quick loan disbursements ensure quick access to funds and enable customers to drive their dream cars without delay.Car Loan Interest Rate

Making informed decisions for a smooth journey

Knowledge really is power when navigating the terrain of car loans. By understanding the nuances of interest rates, using car loan calculators and exploring offers from reputed lenders like SBI and HDFC, borrowers can confidently embark on the journey of car ownership. It is essential to do thorough research, compare loan terms and carefully assess repayment obligations to secure the best deal. With careful planning and informed decision-making, individuals can drive away with their desired vehicle while remaining financially prudent.

Conclusion:

In conclusion, car loans serve as indispensable financial tools that enable individuals to fulfill their car ownership aspirations. By understanding the importance of interest rates, utilizing the capabilities of car loan calculators and exploring offers from reputed lenders like SBI and HDFC, borrowers can easily navigate the intricacies of car financing. After all, making informed decisions and prioritizing affordability ensures a smooth and rewarding journey to owning a valued vehicle.

Pingback: Chack Sbi Car Loan Interest Rate 2024